A company doing millwork and hardwood manufacturing in Wisconsin continued to grow and add more buildings and electrical meters for several years.

Each time they added a new electrical service, they continued to place the same tax exemption on each meter.

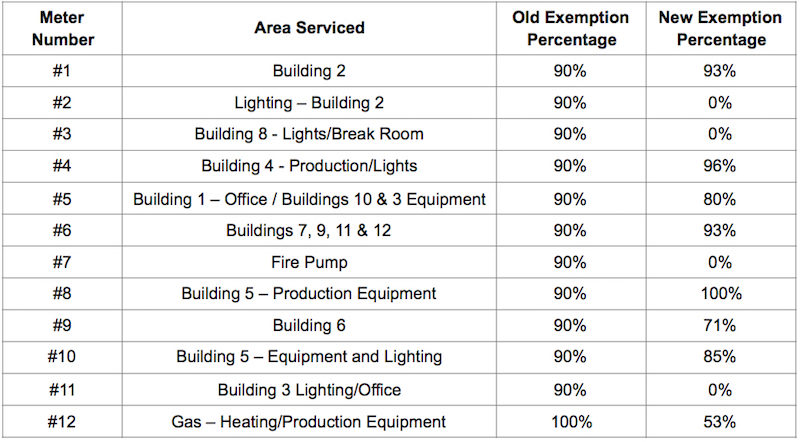

In total, they ended up with 14 electric meters all claiming a 90% sales tax exemption.

Recently, an auditor in Wisconsin took notice and asked this company to provide evidence to document their claimed exemptions.

The company now had to think of what they were going to do to answer the State’s questions.They decided to reach out to SM Engineering Company to do a Predominant Use Tax Study for them.

SM Engineering’s team of engineers visited the facility to gather information regarding the company’s specific utility usages. SME then put together individual audits for all electrical services at the facility. The compiled information was then provided to the State and Utility Companies to update the claimed exemption percentages for all accounts with proper documentation.

The summary of the changes made are as follows:

This is what the Wisconsin Department of Revenue has to say, “I (the company) understand that failure to remit the use tax may result in a future liability that my include tax, interest, and penalty.” SM Engineering worked to place exemptions on the accounts in an accurate manner by putting in the time and attention to detail for each case at hand.